It is the property owners responsibility to contact the Township if they did not receive the property tax bill. Please contact the Township for a copy of your bill or balance information if you did not receive your property tax bill.

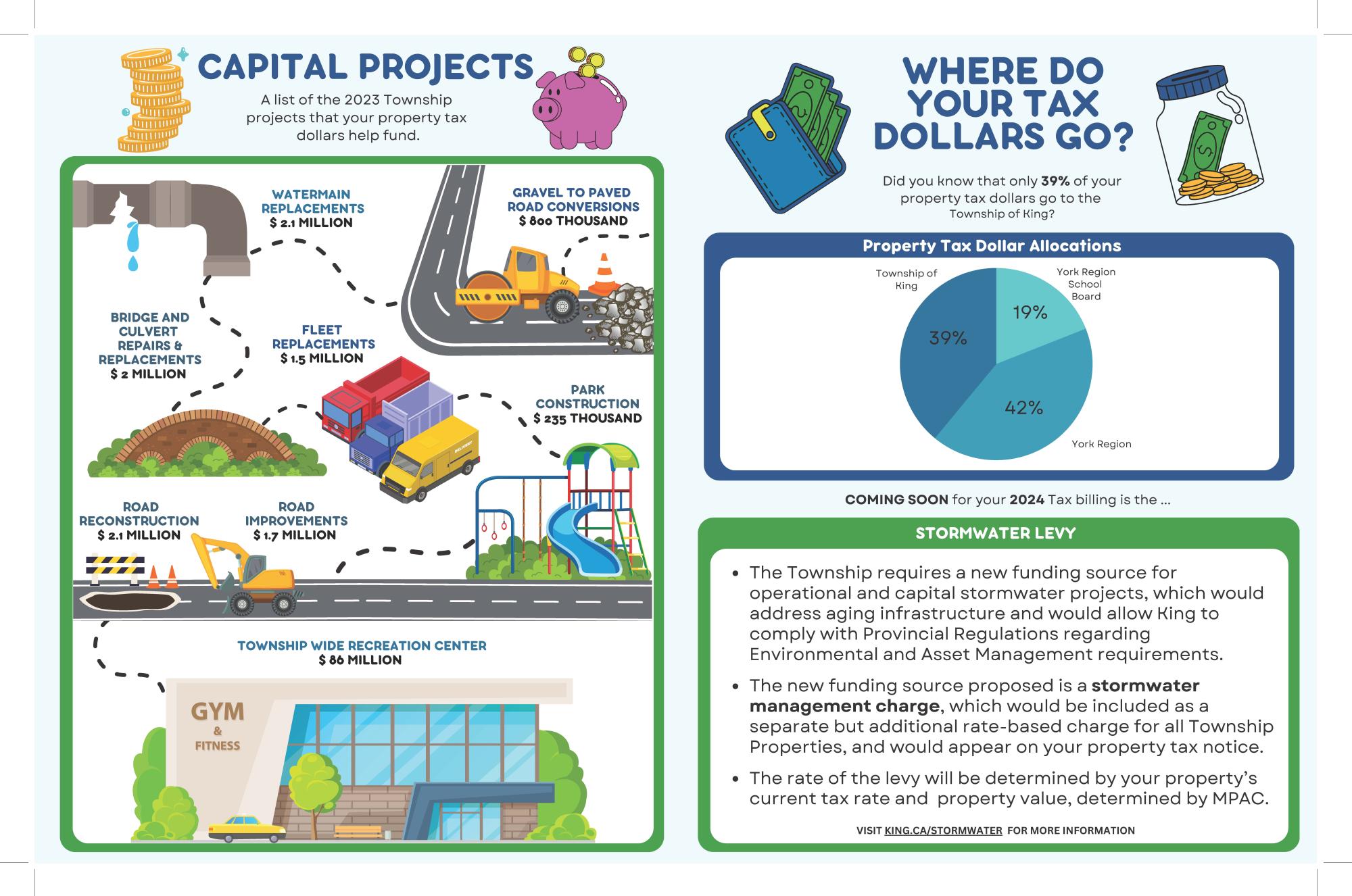

Where Do Your Tax Dollars Go?

Check out the video below to learn all about how your tax dollars are divided and invested into municipal programs and services!

Property Tax Information

2025 Tax Due Dates:

- February 19, 2025

- April 23, 2025

- July 24, 2025

- September 25, 2025

The Tax By-law 2025-041 was passed by Council establishing the final tax due dates.

Property Class

Interim Tax Notices Mail out

1st Instalment

due date2nd Instalment

due dateResidential / Farm

June 2025

July 24, 2025

September 25, 2025

Commercial / Industrial

June 2025

July 24, 2025

September 25, 2025

Failure to receive a property tax notice does not eliminate your responsibility from payment and/or penalty due to late payment. If you do not receive your billing please contact the Township to update your mailing information.

The interim tax levy is calculated based on 50% of last year's annualized taxes.

The final tax levy is determined by multiplying the Current Assessed Value (known as "Assessment") of your property by the Annual Tax Rate for the property type (known as "Property Class").

The 2025 Total Tax Rates for each property class in the Township of King are shown below. These tax rates include Township, Region and Education Taxes.

Education tax rates are set by the Government of Ontario and the Region of York tax rates are established by Regional Council, both of these will also be applied to the assessed value of your property provided by MPAC. For questions about your property taxes, please contact the Township of Service King Department at 905-833-5321 or serviceking@king.ca.

MPAC

The Municipal Property Assessment Corporation's (MPAC) role is to accurately value and classify properties in Ontario in accordance with the Assessment Act and regulations established by the Ontario Government.

Every four years, MPAC perform Assessment Update as part of Ontario's assessment cycle. The last province-wide Assessment Update took place in 2016. The new assessment on the return of the Assessment Roll reflects the legislated January 1, 2016 valuation date for re-assessment review cycle 2017 to 2020. Updated Property Assessment Notices were sent by MPAC to residential property owners in June of 2016 and notices for business properties and farms were sent in the fall of 2016.

The assessment values on the MPAC notice will be used to calculate your property taxes for the years 2017 to 2020. An assessment increase does not necessarily result in an increase in your property taxes. For questions regarding your property assessment value or classification, please contact MPAC.

To learn about how your property assessment impacts your property taxes, go to MPAC, or watch the helpful video below:

Have a question or concern about your property assessment value or classification. Please visit their website at www.mpac.ca or contact the Municipal Property Assessment Corporation (MPAC).

For first time homeowners there is a lot of helpful information on MPAC's website, please visit their First-Time Homeowners' Hub for more information.

Changing Your School Support

In March 2023, MPAC launched a School Support Portal and has made available an Application for Direction of School Support (ADSS) form on the Changing Your School Support page on mpac.ca.

Direct Links to the forms:

English - https://www.mpac.ca/sites/default/files/docs/pdf/ADSS-new-form-EN.pdf

French - https://www.mpac.ca/sites/default/files/docs/pdf/ADSS-new-form-FR.pdfFor more information on property assessment and how it affects your taxes please visit MPAC.

If you believe your property assessment is incorrect, or are waiting for a change in assessment/classification from either MPAC, Agricorp, or Ministry of Natural Resources, payment is still due as billed and failure to make payments will incur penalties and interest.

Call

1-866-296-MPAC (6722)

1-877-889-MPAC (6722) TTYWrite

P.O. Box 9808

Toronto, ON M1S 5T9Website/ email

Fax

1-866-297-6703

Property Tax bills are mailed twice a year, once in January and once in June. Each tax notice has two due dates on it.

E-Billing is now available, please complete the form here.

For newly constructed homes or buildings, the property taxes may not have been assessed in full at the time when the Final Tax Notice was generated. The Tax Notice(s) only captured the value of the land if the building portion has yet to be determined.

Supplemental Tax Notices will be sent if MPAC's assessment of your property has increased due to:

- Completed renovations or improvements to a building on your property

- A new building has been constructed on your property

- The use of the property has changed causing a change in the tax class

- A newly constructed home now has occupancy

The Municipal Property Assessment Corporation (MPAC) determines the assessed values for all properties in Ontario. Due to the volume of buildings to be assessed in Ontario, your property may not be fully assessed in the current taxation year.

It can take MPAC up to three years after occupancy of your newly constructed home for the property assessment to reflect both your land and house. Any taxes owing on the building will be retro-active to the date of occupancy and you will receive Supplementary Notice(s) to reflect the taxes owing for current and/or prior years. Once this process is completed, the valuation for land and building will be combined and levied accordingly in subsequent taxation years.

If you would like to discuss your assessment you can contact MPAC at www.MPAC.ca or 1-866-296-6722.

If you are currently enrolled in our Pre-Authorized Debit Payment Plan (PAD), your supplemental taxes will not be included in this program, please pay the bill separately to the Township of King.

Payment can be made at most financial institutions or by telephone and online banking. Cheques can also be mailed or dropped off at the Municipal Office at 2585 King Rd.

Some properties in King have a charge on their tax notice for the Holland Marsh Drainage System (HMDS), this is for actual maintenance and/or construction costs authorized by the HMDS Board pursuant to Section 78 of the Ontario Drainage Act. Allocation of costs to landowners ensure upstream lands tributary to the canals which comprise the HMDS and not just the interior marsh lands with respect to the canal reconstruction project and/or construction cost.

For further information regarding this matter please reference By-Law 2025-042, or visit the Holland Marsh Drainage Board Website at: www.hollandmarsh.org or phone 905-778-4321.

Effective 2024 the Township will implement a Stormwater Levy.

- The Township requires a new funding source for operational and capital stormwater projects, which would address aging infrastructure and would allow King to comply with Provincial Regulations regarding Environmental and Asset Management requirements.

- The new funding source proposed is a stormwater management charge, which would be included as a separate but additional rate-based charge for all Township Properties, and would appear on your property tax notice.

- The rate of the levy will be determined by your property's current tax rate and property value, determined by MPAC.

For more information please read about Stormwater Management.

* Stormwater Levy effective 2024

Disclaimer: This property tax estimator provides estimates only. Tax Bills containing your final amounts are mailed out by the Township of King and may differ from those presented by this Estimator. Due to variances in rounding, actual allocations may differ. This application is unsuitable for purposes of transacting property sales or any other legally binding matters. To whatsoever, including indirect, special, consequential or incidental damages, arising out of or in connection with your use of, or inability to use, this application.

This property tax calculator will be updated annually to reflect the current year after the final tax rate is calculated.

Please be aware that calculations cannot accommodate the specific charges of every property (e.g. local improvements, business improvement area charges) and will therefore provide ESTIMATED TAXES ONLY.

For information on your property, please contact Service King at 905-833-5321 or serviceking@king.ca

Payment Options

The penalty charge for late payment of property taxes is 1.25% per month on the unpaid balance. The penalty is added on the first day of each and every month during which the default continues.

The Township offers two PAD plans: a Monthly Plan where payments are withdrawn on a monthly basis for ten months (two sets of five equal payments, one from February to June and one from August to December); and an Installment Plan where payments are withdrawn on the scheduled due dates. To sign up for either program please complete the PAD Application.

Payments can be made through your online or telephone banking. You will have to go through your banks website to set up the Township as a payee. In most cases you will look for "King Tax." The tax account number is your roll number and you will need to include all fifteen digits, but do not include the dashes (for example: 000123456780000). If you choose to pay electronically please allow five business days for the bank to process your payment.

Taxes can be paid at any financial institution. Please all five business days for the bank to process your payment.

You are able to mail in a cheque, please include your tax stub and write your roll number on your cheque. Please remember that the tax payer assumes all responsibility if a payment is delivered late.

Make cheques payable to the Township of King and send or drop off to:

Township of King

Finance Department

2585 King Road

King City, ON

L7B 1A1Your tax payment can be dropped off at the municipal office between 8:30 a.m. and 4:30 p.m. Monday to Friday.

The Township of King Municipal Centre is located at 2585 King Road, King City.

Post-dated cheques will be accepted and processed on the date indicated on the cheque. Please make the cheque payable to the Township of King and write the roll number on the front of your cheque.

Taxes can be paid through our website using a credit card. Please note there is an additional 2.5% fee to use this service. To pay your taxes online click here.

Please note, no credit card payments will be accepted in-person for property taxes.

Tax Relief

The Regional Municipality of York administers a Tax Deferral Program for seniors over 65 years of age, low-income seniors, or low-income disable persons. You must own your principal residence in York Region and must be the owner of the property on January 1st of the taxation year for which the deferral has been requested. All deferred taxes must be repaid in full prior to transfer of title on sale of the subject property.

To determine your eligibility for participation in a property tax deferral program, please contact the Finance Department at the Township of King 905-833-5321 (ext. 4572). Applications must be received no later than September 30th of the taxation year for which you are requesting a deferral of property taxes.

Extraordinary circumstances are extreme, unforeseen, typically one-time, situations that prevent a taxpayer from being able to make their property tax payment by the due date. These types of situations are unforeseen at the time a taxpayer receives their property tax bill.If eligible, owners may submit an application to the Treasurer to have their interest waived for up to six months with options to renew if needed.

Extraordinary Circumstances and Required Documents Extraordinary Circumstance Required Documentation Severe illness or injury to yourself or immediate family member (requiring hospitalization or medical care) Medical letter or certificate Death in the immediate family Death certificate

A victim of a criminal act, such as bank fraud Police report or letter from a financial institution Significant fire damage that renders the property substantially unusable Records report from the Fire Department Sequestered on the due date because of jury duty Documentation supporting sequestering from applicable court Immediate family is defined under Canada Labour Code as being the person’s spouse or common-law partner; father and mother and the spouse or common-law partner of the father or mother, the person’s children and the children of the person’s spouse or common-law partner; brother or sister, the grandfather or grandmother; the father and mother of the spouse or common-law partner of the person and the spouse or common- law partner of the father or mother and any relative of the owner who resides permanently with the property owner or with whom the property owner permanently resides.

To apply for the Extraordinary Circumstances Tax Relief Program click here.

A Section 357 Tax Application is filed due to a change of event that occurred during the current taxation year. This could be a fire or demolition of house. The deadline for submitting an application is February 28th of the year following the taxation year to which the application relates.

A Section 358 Tax Application is to cancel, reduce or refund taxes for one or both of the two years preceding the year in which the application is made. Applications may be filed for any overcharge caused by a gross or manifest error in the preparation of the assessment roll that is clerical or factual in nature, including a typographical error, or similar errors, but not an error in judgment in assessing the property. The deadline for submitting an application is February 28th of the year following the taxation year to which the application relates.

To submit a Section 357 or 358 Application please complete this form.

- Must own property that is considered Conservation Land

- Deadline to apply is July 31st of the current year

- For the Application and Information please visit: www.ontario.ca/page/conservation-land-tax-incentive-program

If you believe your property assessment is incorrect, or are waiting for a change in assessment/classification from either MPAC, Agricorp, or Ministry of Natural Resources, payment is still due as billed and failure to make payments will incur penalties and interest.

- Property must be deemed farmland by Agricorp

- Deadline date will be specified on the application

- For the Application and Information please contact Agricorp by:

- Phone: 1-888-247-4999

- Email: Contact@agricorp.com

If you believe your property assessment is incorrect, or are waiting for a change in assessment/classification from either MPAC, Agricorp, or Ministry of Natural Resources, payment is still due as billed and failure to make payments will incur penalties and interest.

- Must have property that contains a forest

- Deadline to apply is June 30th of the current year

- For the Application and Information please visit: www.ontariowoodlot.com (search MFTIP program)

If you believe your property assessment is incorrect, or are waiting for a change in assessment/classification from either MPAC, Agricorp, or Ministry of Natural Resources, payment is still due as billed and failure to make payments will incur penalties and interest.

New Homeowner Information Guide

Sale of Property by Public Tender

A full copy of the tax sale advertisement and further information about this matter is available online at www.OntarioTaxSales.ca or you may contact: Peggy Tollett - Director of Finance/Treasurer 905-833-5321 ext.4010