King Township is committed to keeping business supported and informed during the pandemic.

Latest News

Today, Dr. Kieran Moore, Chief Medical Officer of Health, issued the following statement on the lifting of remaining provincial masking requirements:

“With high vaccination rates and Ontario’s COVID-19 situation continuing to improve, most of the province’s remaining provincial masking requirements, including on public transit, will expire as of 12:00 a.m. on June 11, 2022.

To continue providing an additional layer of protection for the most vulnerable, masks will still be required in long-term care and retirement homes. Masking is recommended in higher-risk congregate living settings, such as shelters and group homes.

On June 11, 2022, remaining Directives will also be revoked and replaced with Ministry of Health guidance for health care workers and organizations. This includes guidance on when masks should be worn in hospitals and other health care settings.

While masking requirements are expiring, organizations may implement their own policies. Ontarians should continue to wear a mask if they feel it is right for them, are at high risk for severe illness, recovering from COVID-19, have symptoms of the virus or are a close contact of someone with COVID-19.

Thanks to the efforts of all Ontarians following public health measures and getting vaccinated we have made significant progress in the fight against COVID-19. However, I want to remind Ontarians to stay home when sick and, most importantly, get vaccinated and boosted if eligible. Staying up to date with vaccination is the best protection against severe outcomes and will help us maintain the progress we have made.

The province will continue to monitor for any significant changes, including any new variants of concern, to ensure we are adapting our response to protect the health and safety of all Ontarians.”

As Ontario continues to effectively manage the sixth wave of COVID-19, the Chief Medical Officer of Health is maintaining existing provincial masking requirements in select higher-risk indoor settings until June 11, 2022.

“To protect our progress in managing this latest wave, I am maintaining masking requirements in specific public settings where individuals who are, or may be, at increased risk of severe outcomes, are in close contact for extended periods of time,” said Dr. Kieran Moore, Chief Medical Officer of Health. “Continuing to follow masking requirements and keeping up to date with COVID-19 vaccinations are the best ways we can prevent transmission and protect our friends, families, and our communities.”

Provincial masking requirements which were set to expire on April 27, 2022 are being extended in current settings until 12:00 a.m. on June 11, 2022, including:

- public transit;

- health care settings (e.g., hospitals, doctors’ offices, clinics that provide health care services, laboratories, specimen collection centres, and home and community care);

- long-term care homes;

- retirement homes; and

- shelters and other congregate care settings that provide care and services to medically and socially vulnerable individuals.

A complete list of settings where masking requirements continue to apply is available online.

The Chief Medical Officer of Health will also maintain the CMOH Directives currently in effect until June 11, 2022, after which the ministry will issue guidance on personal protective equipment recommendations for infection prevention and control in health care settings.

Given the province’s high vaccination rates, expansion of booster doses, as well as the arrival of antivirals, Ontario has the tools necessary to manage the impact of the virus. The Chief Medical Officer of Health and the province will continue to monitor key indicators and the COVID-19 situation across Ontario.

Expanding Ontario’s Tools to Manage COVID-19 and Stay Open

While the province adapts to managing and living with COVID-19, the Ontario government is using every tool available to protect hospital capacity and ensure Ontario can stay open. This includes continuing masking in high-risk settings, expanding eligibility for fourth doses of the COVID-19 vaccine and expanding access to antiviral treatments such as Paxlovid.

To further expand the tools available to protect Ontarians and reduce hospital visits, the province will start to receive supplies of Evusheld, an antibody treatment for immunocompromised individuals who are not positive for COVID-19 at the time of administration. Following two single-dose injections, the treatment provides protection from COVID-19 for six months.

Based on advice from the Canadian Agency for Drugs and Technologies in Health (CADTH), Evusheld will be available to individuals with the highest-risk of a severe outcome from COVID-19 in the coming weeks, including:

- solid organ transplant recipients;

- stem cell transplant recipients;

- CAR-T therapy recipients; and

- other hematologic cancer patients undergoing treatment.

“Thanks to the province’s high vaccination rates as well as an increase in antiviral treatment availability and eligibility, we have been able to cautiously and gradually reopen Ontario,” said Christine Elliott, Deputy Premier and Minister of Health. “Vaccination remains our best protection against COVID-19, and I strongly recommend that everyone stays up to date with their vaccinations by receiving the dose you are eligible for as soon as you can. As with vaccines for other diseases, you are protected best when you stay up to date.”

Today, Dr. Kieran Moore, Chief Medical Officer of Health issued the following statement:

“With the peak of Omicron behind us, Ontario has been able to cautiously and gradually move through its reopening milestones.

The majority of public health and workplace safety measures have now been lifted, and key public health indicators continue to improve or remain stable.

As we continue on this path, we are able to take a more balanced and long-term approach to Ontario’s pandemic response.

With continued improvement in trends, Ontario will remove the mandatory masking requirement for most settings on March 21, with the exception of select settings such as public transit, health care settings, long-term care homes and congregate care settings.

As a society, we must remain kind, considerate and respectful toward those who continue wearing a mask. We must also expect indicators, such as cases and hospitalizations, to increase slightly as Ontarians increasingly interact with one another. However, thanks to our high vaccination rates and natural immunity, as well as the arrival of antivirals, Ontario has the tools necessary to manage the impact of the virus.

I want to thank Ontarians for their ongoing resilience and commitment to community as we navigated this global pandemic together. Your sacrifices and collective actions have made a difference.

While this does not signal that COVID-19 has disappeared or that the pandemic is over, it does mean that we have come to a place where we know what we need to do to manage this virus and to keep each other safe.

We need to remain vigilant. We need to stay home when sick. And, most importantly, we need to get vaccinated and boosted.

Vaccination is the best protection against COVID-19 and the best protection for the progress we have made.”

With key public health and health system indicators continuing to improve, the Ontario government, in consultation with the Chief Medical Officer of Health, is cautiously and gradually easing public health measures sooner, with the next phase of measures being eased on February 17, 2022 at 12:01 a.m.

“Given how well Ontario has done in the Omicron wave we are able to fast track our reopening plan,” said Premier Doug Ford. “This is great news and a sign of just how far we've come together in our fight against the virus. While we aren’t out of the woods just yet we are moving in the right direction.”

Last month, Ontario released its plan to follow a cautious and phased approach to lifting public health and workplace safety measures if health indicators continued to remain stable and improve. Positivity rates have fallen and new admissions to hospital and ICU have been declining week over week, signalling that the Omicron peak is behind us. Over the coming days and weeks, these trends are expected to continue, allowing the province to safely accelerate its timelines.

“Thanks to the province’s high vaccination rates and the continued sacrifices of Ontarians, we are now in a position where we can move forward in our plan earlier than anticipated,” said Christine Elliott, Deputy Premier and Minister of Health. “With hospitalizations and ICU admissions continuing to decline, we are committed to maintaining a gradual and cautious approach to protect our hospital capacity and ensure patients can access the care they need when they need it.”

Effective February 17, 2022

Ontario will further ease public health measures, including, but not limited to:

- Increasing social gathering limits to 50 people indoors and 100 people outdoors

- Increasing organized public event limits to 50 people indoors, with no limit outdoors

- Removing capacity limits in the following indoor public settings where proof of vaccination is required, including but not limited to:

- Restaurants, bars and other food or drink establishments without dance facilities

- Non-spectator areas of sports and recreational fitness facilities, including gyms

- Cinemas

- Meeting and event spaces, including conference centres or convention centres

- Casinos, bingo halls and other gaming establishments

- Indoor areas of settings that choose to opt-in to proof of vaccination requirements.

- Allowing 50 per cent of the usual seating capacity at sports arenas

- Allowing 50 percent of the usual seating capacity for concert venues and theatres

- Increasing indoor capacity limits to 25 per cent in the remaining higher-risk settings where proof of vaccination is required, including nightclubs, restaurants where there is dancing, as well as bathhouses and sex clubs

- Increasing capacity limits for indoor weddings, funerals or religious services, rites, or ceremonies to the number of people who can maintain two metres physical distance. Capacity limits are removed if the location opts-in to use proof of vaccination or if the service, rite, or ceremony is occurring outdoors.

Capacity limits in other indoor public settings, such as grocery stores, pharmacies, retail and shopping malls, will be maintained at, or increased to, the number of people who can maintain two metres physical distance.

In addition, as of 8:00 a.m. on Friday, February 18, 2022, Ontario is expanding booster dose eligibility to youth aged 12 to 17. Appointments can be booked through the provincial booking system and the Provincial Vaccine Contact Centre, as well as at select pharmacies administering the Pfizer vaccine. Appointments will be booked for approximately six months (168 days) after a second dose. To book an appointment online, individuals must be 12 years old at the time of appointment.

Effective March 1, 2022

Ontario intends to take additional steps to ease public health measures if public health and health system indicators continue to improve. This includes lifting capacity limits in all remaining indoor public settings.

Ontario will also lift proof of vaccination requirements for all settings at this time. Businesses and other settings may choose to continue to require proof of vaccination. Masking requirements will remain in place at this time, with a specific timeline to lift this measure to be communicated at a later date.

To manage COVID-19 over the long-term, public health units can deploy local and regional responses based on local context and conditions.

“Thanks to the efforts of Ontarians to help blunt the transmission of Omicron, our health care indicators suggest a general improvement in the COVID-19 situation in the province,” said Dr. Kieran Moore, Chief Medical Officer of Health. “We are now in a position to lift more public health measures, but it is important to stay vigilant, as we don’t want to cause any further disruption to people’s everyday lives. We must continue to prevent the transmission of COVID-19 in our communities by following the measures in place and by vaccinating those who have not yet received their doses.”

Time-limited Measures to Blunt Spread of Omicron Protecting Hospital and Health Care Capacity.

With key public health and health care indicators starting to show signs of improvement, the Ontario government, in consultation with the Chief Medical Officer of Health, today released details of steps to cautiously and gradually ease public health measures, starting on January 31, 2022.

“The evidence tells us that the measures we put in place to blunt transmission of Omicron are working,” said Premier Doug Ford. “We can be confident that the worst is behind us and that we are now in a position to cautiously and gradually ease public health measures. While February will continue to present its own challenges, given current trends these are challenges we are confident we can manage.”

As a result of the additional public health measures enacted on January 5, 2022, the province is beginning to see signs of stabilization in key public health and health system indicators. Per cent positivity has fallen and new admissions to hospital have started to stabilize with length of stay shortening considerably. Over the coming days and weeks, these trends are expected to continue, allowing the province to begin cautiously easing public health measures.

In the absence of concerning trends in public health and health care indicators, Ontario will follow a cautious and phased approach to lifting public health measures, with 21 days between each step.

January 31, 2022

Effective January 31, 2022 at 12:01 a.m. Ontario will begin the process of gradually easing restrictions, while maintaining protective measures, including but not limited to:

- Increasing social gathering limits to 10 people indoors and 25 people outdoors.

- Increasing or maintaining capacity limits at 50 per cent in indoor public settings, including but not limited to:

- Restaurants, bars and other food or drink establishments without dance facilities;

- Retailers (including grocery stores and pharmacies)

- Shopping malls;

- Non-spectator areas of sports and recreational fitness facilities, including gyms;

- Cinemas;

- Meeting and event spaces;

- Recreational amenities and amusement parks, including water parks;

- Museums, galleries, aquariums, zoos and similar attractions; and

- Casinos, bingo halls and other gaming establishments

- Religious services, rites, or ceremonies.

- Allowing spectator areas of facilities such as sporting events, concert venues and theatres to operate at 50 per cent seated capacity or 500 people, whichever is less.

Enhanced proof of vaccination, and other requirements would continue to apply in existing settings.

February 21, 2022

Effective February 21, 2022, Ontario will lift public health measures, including:

- Increasing social gathering limits to 25 people indoors and 100 people outdoors.

- Removing capacity limits in indoor public settings where proof of vaccination is required, including but not limited to restaurants, indoor sports and recreational facilities, cinemas, as well as other settings that choose to opt-in to proof of vaccination requirements.

- Permitting spectator capacity at sporting events, concert venues, and theatres at 50 per cent capacity.

- Limiting capacity in most remaining indoor public settings where proof of vaccination is not required to the number of people that can maintain two metres of physical distance.

- Indoor religious services, rites or ceremonies limited to the number that can maintain two metres of physical distance, with no limit if proof of vaccination is required.

- Increasing indoor capacity limits to 25 per cent in the remaining higher-risk settings where proof of vaccination is required, including nightclubs, wedding receptions in meeting or event spaces where there is dancing, as well as bathhouses and sex clubs.

Enhanced proof of vaccination, and other requirements would continue to apply in existing settings.

March 14, 2022

Effective March 14, 2022, Ontario will take additional steps to ease public health measures, including:

- Lifting capacity limits in all indoor public settings. Proof of vaccination will be maintained in existing settings in addition to other regular measures.

- Lifting remaining capacity limits on religious services, rites, or ceremonies.

- Increase social gathering limits to 50 people indoors with no limits for outdoor gatherings.

To manage COVID-19 over the long-term, local and regional responses by public health units may be deployed based on local context and conditions.

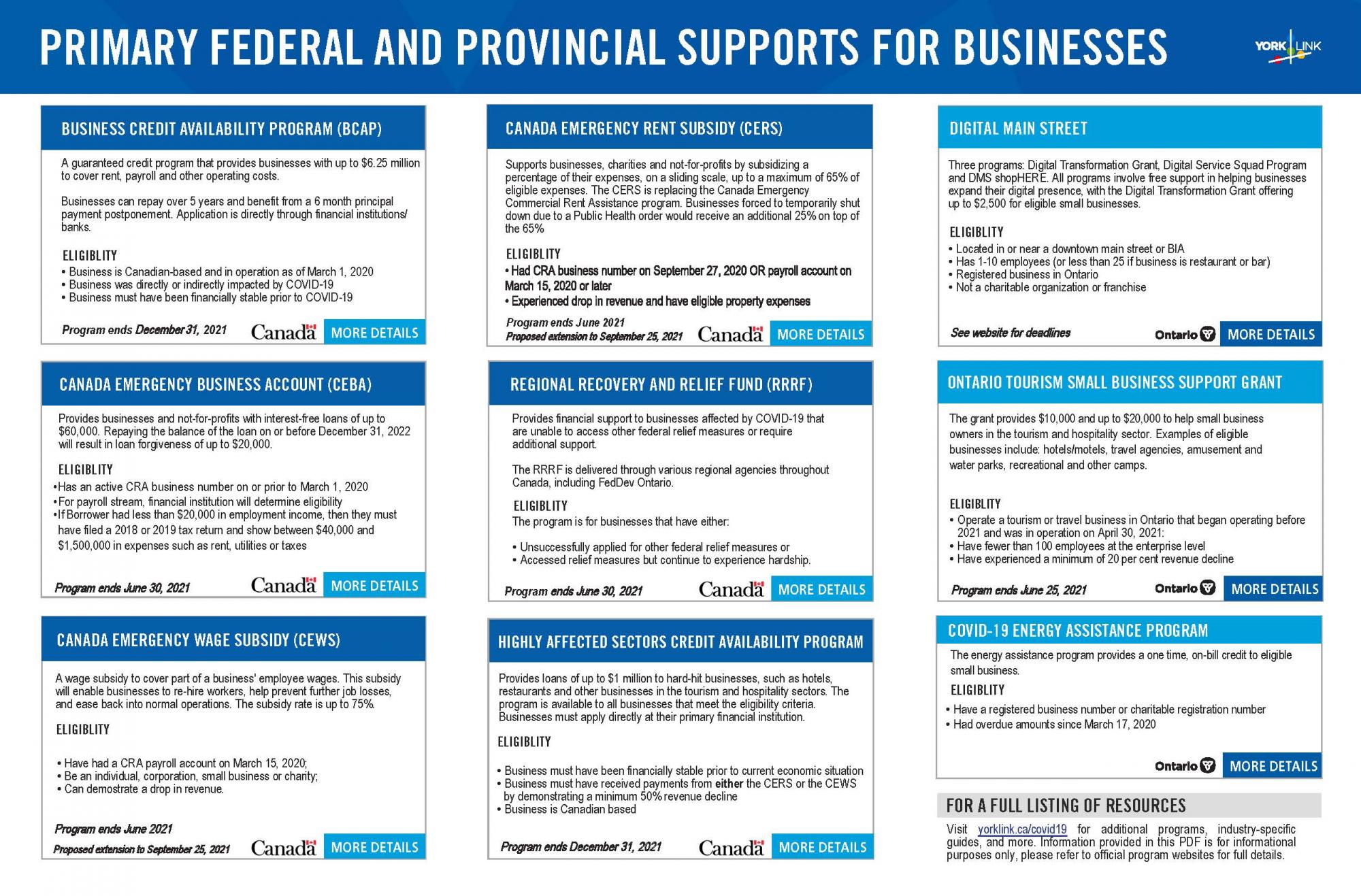

Province’s plan includes $10,000 grant for eligible small businesses and additional electricity-rate relief.

The Ontario government is providing targeted relief for businesses and people impacted by the current public health measures aimed at blunting the spread of the Omicron variant. As part of this plan, the government is introducing a $10,000 grant for eligible businesses that are subject to closures under the modified Step Two of the Roadmap to Reopen and is providing additional electricity-rate relief for businesses, as well as workers and families spending more time at home.

“Our government understands that public health measures needed to blunt the spread of the Omicron variant are impacting the lives and livelihoods of small businesses, workers and families across Ontario,” said Peter Bethlenfalvy, Minister of Finance. “Since the first day of the pandemic, we have provided unprecedented levels of support to protect people, jobs and our economy. We will continue to deliver on that commitment.”

As part of a comprehensive plan to support workers and businesses, the government is announcing an Ontario COVID-19 Small Business Relief Grant for small businesses that are subject to closure under the modified Step Two of the Roadmap to Reopen. It will provide eligible small businesses with a grant payment of $10,000.

Eligible small businesses include:

- Restaurants and bars;

- Facilities for indoor sports and recreational fitness activities (including fitness centres and gyms);

- Performing arts and cinemas;

- Museums, galleries, aquariums, zoos, science centres, landmarks, historic sites, botanical gardens and similar attractions;

- Meeting or event spaces;

- Tour and guide services;

- Conference centres and convention centres;

- Driving instruction for individuals; and

- Before- and after- school programs.

Eligible businesses that qualified for the Ontario Small Business Support Grant and that are subject to closure under modified Step Two of the Roadmap to Reopen will be pre-screened to verify eligibility and will not need to apply to the new program. Newly established and newly eligible small businesses will need to apply once the application portal opens in the coming weeks. Small businesses that qualify can expect to receive their payment in February.

The Ontario government is also providing electricity-rate relief to support small businesses, as well as workers and families spending more time at home while the province is in Modified Step Two. For 21 days starting at 12:01 am on Tuesday, January 18, 2022, electricity prices will be set 24 hours a day at the current off-peak rate of 8.2 cents per kilowatt-hour, which is less than half the cost of the current on-peak rate. The off-peak rate will apply automatically to residential, small businesses and farms who pay regulated rates set by the Ontario Energy Board and get a bill from a utility and will benefit customers on both Time-of-Use and Tiered rate plans.

In response to recent trends that show an alarming increase in COVID-19 hospitalizations, the Ontario government, in consultation with the Chief Medical Officer of Health, is temporarily moving the province into Step Two of its Roadmap to Reopen with modifications that take into account the province’s successful vaccination efforts. These time-limited measures will help blunt transmission and prevent hospitals from becoming overwhelmed as the province continues to accelerate its booster dose rollout. As part of the province’s response to the Omicron variant, starting January 5, students will pivot to remote learning with free emergency child care planned for school-aged children of health care and other eligible frontline workers.

“As we continue with our provincial vaccine booster efforts, we must look at every option to slow the spread of the highly contagious Omicron variant,” said Premier Doug Ford. “Putting these targeted and time-limited measures in place will give us more opportunity to deliver vaccines to all Ontarians and ensure everyone has maximum protection against this virus.”

Unlike other variants throughout the pandemic, evolving data is showing that while the Omicron variant is less severe, its high transmissibility has resulted in a larger number of hospital admissions relative to ICU admissions. Staff absenteeism is also expected to rise and affect operations in workplaces across Ontario due to Omicron infection and exposure, including in hospitals and schools. Real-world experience and evidence in Ontario reveal that approximately one per cent of Omicron cases require hospital care. The rapid rise of Omicron cases, which may soon number in the hundreds of thousands, could result in the province’s hospital capacity becoming overwhelmed if further action isn’t taken to curb transmission. When one in 100 cases goes to hospital, it means that with this rapid increase in transmission the number of new cases requiring hospitalization will also rapidly increase daily. For example, 50,000 cases per day would mean 500 hospital admissions per day, which is greater than the peak daily hospitalizations of 265 per day from last spring, when hospitals were under significant strain during the third wave of the pandemic.

In response, the province will return to the modified version of Step Two of the Roadmap to Reopen effective Wednesday, January 5, 2022 at 12:01 a.m. for at least 21 days (until January 26, 2022), subject to trends in public health and health system indicators.

These measures include:

- Reducing social gathering limits to five people indoors and 10 people outdoors.

- Limiting capacity at organized public events to five people indoors.

- Requiring businesses and organizations to ensure employees work remotely unless the nature of their work requires them to be on-site.

- Limiting capacity at indoor weddings, funerals, and religious services, rites and ceremonies to 50 per cent capacity of the particular room. Outdoor services are limited to the number of people that can maintain 2 metres of physical distance. Social gatherings associated with these services must adhere to the social gathering limits.

- Retail settings, including shopping malls, permitted at 50 per cent capacity. For shopping malls physical distancing will be required in line-ups, loitering will not be permitted and food courts will be required to close.

- Personal care services permitted at 50 per cent capacity and other restrictions. Saunas, steam rooms, and oxygen bars closed.

- Closing indoor meeting and event spaces with limited exceptions but permitting outdoor spaces to remain open with restrictions.

- Public libraries limited to 50 per cent capacity.

- Closing indoor dining at restaurants, bars and other food or drink establishments. Outdoor dining with restrictions, takeout, drive through and delivery is permitted.

- Restricting the sale of alcohol after 10 p.m. and the consumption of alcohol on-premise in businesses or settings after 11 p.m. with delivery and takeout, grocery/convenience stores and other liquor stores exempted.

- Closing indoor concert venues, theatres, cinemas, rehearsals and recorded performances permitted with restrictions.

- Closing museums, galleries, zoos, science centres, landmarks, historic sites, botanical gardens and similar attractions, amusement parks and waterparks, tour and guide services and fairs, rural exhibitions, and festivals. Outdoor establishments permitted to open with restrictions and with spectator occupancy, where applicable, limited to 50 per cent capacity.

- Closing indoor horse racing tracks, car racing tracks and other similar venues. Outdoor establishments permitted to open with restrictions and with spectator occupancy limited to 50 per cent capacity. Boat tours permitted at 50 per cent capacity.

- Closing indoor sport and recreational fitness facilities including gyms, except for athletes training for the Olympics and Paralympics and select professional and elite amateur sport leagues. Outdoor facilities are permitted to operate but with the number of spectators not to exceed 50 per cent occupancy and other requirements.

- All publicly funded and private schools will move to remote learning starting January 5 until at least January 17, subject to public health trends and operational considerations.

- School buildings would be permitted to open for child care operations, including emergency child care, to provide in-person instruction for students with special education needs who cannot be accommodated remotely and for staff who are unable to deliver quality instruction from home.

- During this period of remote learning, free emergency child care will be provided for school-aged children of health care and other eligible frontline workers.

Please view the regulation for the full list of mandatory public health and workplace safety measures.

The Government of Canada is committed to supporting Canadian workers and businesses through the COVID-19 pandemic.

Today, the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance, announced the federal government’s intention to temporarily expand eligibility for key support programs to ensure Canadians are protected and workers and businesses get the help they need to sustain them through new and necessary public health restrictions.

Using regulatory authority provided in Bill C-2, the government intends to introduce new regulations that would:

- Expand the Local Lockdown Program to include employers subject to capacity-limiting restrictions of 50 per cent or more; and reduce the current-month revenue decline threshold requirement to 25 per cent. Eligible employers will receive wage and rent subsidies from 25 per cent up to a maximum of 75 per cent, depending on their degree of revenue loss. The 12-month revenue decline test continues to not be required in order to access this support.

- Expand the Canada Worker Lockdown Benefit to include workers in regions where provincial or territorial governments have introduced capacity-limiting restrictions of 50 per cent or more. As announced previously, this benefit will provide $300 a week in income support to eligible workers who are directly affected by a COVID-19-related public health lockdown, and who have lost 50 per cent or more of their income as a result.

These updated regulations will apply from December 19, 2021, to February 12, 2022, during which time it is expected that public health authorities will continue to implement “circuit-breaker” restrictions that limit the spread of the Omicron variant of COVID-19 across Canada.

More details on the expansion of these support measures are available in the backgrounder associated with today’s announcement.

Rebate program cuts property taxes and energy costs; New cash flow supports providing up to $7.5 billion for businesses, including those affected by Omicron restrictions.

The Ontario government is introducing new supports for many of the businesses that are most impacted by public health measures in response to the Omicron variant. These supports include a new Ontario Business Costs Rebate Program and a six-month interest- and penalty-free period to make payments for most provincially administered taxes.

“Ontario businesses have already contributed so much to the province’s fight against COVID-19,” said Peter Bethlenfalvy, Minister of Finance. “We recognize that these necessary capacity limits to reduce the transmission of the virus will impact businesses, and that’s why we are introducing these new supports, which will put money directly into the hands of business and free up their cash flows during this critical time.”

Through the new Ontario Business Costs Rebate Program, eligible businesses will receive rebate payments equivalent to 50 per cent of the property tax and energy costs they incur while subject to the current capacity limits. This will provide support to businesses that are expected to be most impacted financially by the requirement to reduce capacity to 50 per cent. Examples of businesses that will be eligible for the Ontario Business Costs Rebate Program include restaurants, smaller retail stores and gyms. A full list of eligible business types will be made available through a program guide in mid-January 2022.

Online applications for this program will open in mid-January 2022, with payments to eligible businesses provided retroactive to December 19, 2021. Businesses will be required to submit property tax and energy bills as part of the application process.

“I commend business owners for pivoting quickly as we respond to the Omicron variant in our continued fight against COVID-19,” said Todd Smith, Minister of Energy. “It is essential that we support them during their time of need, and that’s why our new rebate program will provide them with the support they need right now on their energy bills.”

The province is also providing additional support to help improve cash flows for Ontario businesses by providing a six-month interest- and penalty-free period to make payments for most provincially administered taxes, supporting businesses in the immediate term while capacity restrictions are in place while providing the flexibility Ontario businesses will need for long-term planning. The six-month period will begin January 1, 2022 and end July 1, 2022.

This measure will provide up to $7.5 billion in relief to help approximately 80,000 Ontario businesses. With this help, approximately 80,000 businesses will have the option to delay their payments for the following provincially administered taxes, helping them free up cash flow during these challenging times:

Employer Health Tax

Beer, Wine & Spirits Taxes

Tobacco Tax

Insurance Premium Tax

Fuel Tax

International Fuel Tax Agreement

Gas Tax

Retail Sales Tax on Insurance Contracts & Benefit Plans

Mining Tax

Race Tracks TaxIn response to the rapidly-spreading and highly transmissible Omicron variant, the Ontario government, in consultation with the Chief Medical Officer of Health, is applying additional public health and workplace safety measures, including capacity and social gathering limits. These measures will help curb transmission and continue to safeguard the Ontario’s hospitals and ICU capacity as the province continues to rapidly accelerate its booster dose rollout.

“Throughout this entire pandemic, we’ve never faced an enemy like Omicron given how quickly it spreads,” said Premier Doug Ford. “We need to do everything we can to slow its spread as we continue to dramatically ramp up capacity to get as many booster shots into arms as possible. Doing so is the best way to safeguard our hospital and intensive care units.”

The latest modelling suggests that the increased transmissibility of the Omicron variant could put additional strain on Ontario’s hospital capacity, making it critical to slow the spread as the government dramatically increases vaccine capacity and expands eligibility for third booster doses. The province recently doubled its vaccination capacity and continues to ramp up further to get as many vaccines into arms as possible. Over 156,000 doses were administered on December 16, 2021 with capacity increased to 200,000 to 300,000 in the coming days.

To further strengthen its response to Omicron and reduce opportunities for close contact as the province gets as many vaccines into arms as possible, Ontario is introducing a 50 per cent capacity limit in the following indoor public settings:

- Restaurants, bars and other food or drink establishments and strip clubs;

- Personal care services;

- Personal physical fitness trainers;

- Retailers (including grocery stores and pharmacies);

- Shopping malls;

- Non-spectator areas of facilities used for sports and recreational fitness activities (e.g. gyms);

- Indoor recreational amenities;

- Indoor clubhouses at outdoor recreational amenities;

- Tour and guide services; and

- Photography studios and services; and

- Marinas and boating clubs.

These limits do not apply to any portion of a business or place that is being used for a wedding, a funeral or a religious service, rite, or ceremony. Businesses or facilities will also need to post a sign stating the capacity limits that are permitted in the establishment.

To further reduce the spread of COVID-19 and the Omicron variant, additional protective measures are also being applied:

- The number of patrons permitted to sit at a table will be limited to 10 people and patrons will be required to remain seated in restaurants, bars and other food or drink establishments, meeting and event spaces and strip clubs.

- Bars and restaurants, meeting and event spaces and strip clubs will be required to close by 11 p.m. Take out and delivery will be permitted beyond 11 p.m.

- Dancing will not be allowed except for workers or performers.

- Food and/or drink services will be prohibited at sporting events; concert venues, theatres and cinemas; casinos, bingo halls and other gaming establishments; and horse racing tracks, car racing tracks and other similar venues.

- The sale of alcohol will be restricted after 10 p.m. and consumption of alcohol in businesses or settings after 11 p.m.

In addition, to mitigate COVID-19 transmission that can occur at informal social gatherings, the province is also reducing social gathering limits to 10 people indoors and 25 people outdoors.

These restrictions will come into effect on 12:01 a.m. on Sunday, December 19, 2021.

The Ontario government, in consultation with the Chief Medical Officer of Health, has released A Plan to Safely Reopen Ontario and Manage COVID-19 for the Long-Term, which outlines the province’s gradual approach to lifting remaining public health and workplace safety measures by March 2022. The plan will be guided by the ongoing assessment of key public health and health care indicators and supported by local or regional tailored responses to COVID-19.

“Thanks to our cautious and careful approach to re-opening, we are now in position to gradually lift all remaining public health measures over the coming months,” said Premier Doug Ford. “This plan is built for the long term. It will guide us safely through the winter and out of this pandemic, while avoiding lockdowns and ensuring we don’t lose the hard-fought gains we have made.”

Ontario will slowly and incrementally lift all remaining public health and workplace safety measures, including the provincial requirement for proof of vaccination and wearing of face coverings in indoor public settings, over the next six months. This phased approach will be guided by the ongoing assessment and monitoring of key public health and health care indicators, such as the identification of any new COVID-19 variants, increases in hospitalizations and ICU occupancy and rapid increases in transmission to ensure that public health and workplace safety measures are lifted safely.

“Since the beginning of the pandemic, Ontario has taken a cautious approach to reopening to protect the health and safety of Ontarians,” said Christine Elliott, Deputy Premier and Minister of Health. “Our plan will ensure we replicate this success and take a gradual approach that will protect our health system capacity, prevent widespread closures, keep our schools open and support the province’s economic recovery.”

In the absence of concerning trends, public health and workplace safety measures will be lifted based on the proposed following milestones:

October 25, 2021

In response to continued improvements to key indicators, including ongoing stability in the province’s hospitals, effective October 25, 2021 at 12:01 a.m., Ontario will lift capacity limits in the vast majority of settings where proof of vaccination are required, such as restaurants, bars and other food or drink establishments; indoor areas of sports and recreational facilities such as gyms and where personal physical fitness trainers provide instruction; casinos, bingo halls and other gaming establishments; and indoor meeting and event spaces. Limits will also be lifted in certain outdoor settings.

At this time, the government will also allow other settings to lift capacity limits and physical distancing requirements if they choose to require proof of vaccination, including:

- Personal care services (e.g., barber shops, salons, body art);

- Indoor areas of museums, galleries, aquariums, zoos, science centres, landmarks, historic sites, botanical gardens and similar attractions;

- Indoor areas of amusement parks;

- Indoor areas of fairs, rural exhibitions, festivals;

- Indoor tour and guide services;

- Boat tours;

- Indoor areas of marinas and boating clubs;

- Indoor clubhouses at outdoor recreational amenities;

- Open house events provided by real estate agencies; and

- Indoor areas of photography studios and services.

Locations where a wedding, funeral or religious service, rite or ceremony takes place may also implement proof of vaccination requirements for services, rites, or ceremonies at the location.

This will not apply to settings where people receive medical care, food from grocery stores and medical supplies. In addition, the government intends to allow for greater capacity at organized public events such as Remembrance Day ceremonies and Santa Claus parades with more details coming in the near future.

November 15, 2021

The government intends to lift capacity limits in the remaining higher-risk settings where proof of vaccination is required, including food or drink establishments with dance facilities (e.g., night clubs, wedding receptions in meeting/event spaces where there is dancing); strip clubs, bathhouses and sex clubs.

January 17, 2022

In the absence of concerning trends in public health and health care following the winter holiday months and after students returned to in-class learning, the province intends to begin gradually lifting capacity limits in settings where proof of vaccination is not required. The Chief Medical Officer of Health will also lift CMOH directives as appropriate.

Proof of vaccination requirements may also begin to be gradually lifted at this time, including for restaurants, bars and other food and drink establishments, facilities used for sports and recreational facilities and casinos, bingo halls and other gaming establishments.

February 7, 2022

The government intends to lift proof of vaccination requirements in high-risk settings, including night clubs, strip clubs, and bathhouses and sex clubs.

March 28, 2022

At this time, it is intended that remaining public health and workplace safety measures will be lifted, including wearing face coverings in indoor public settings. Recommendations may be released for specific settings, if appropriate.

In addition, the provincial requirement for proof of vaccination will be lifted for all remaining settings, including meeting and event spaces, sporting events, concerts, theatres and cinemas, racing venues and commercial and film productions with studio audiences.

To manage COVID-19 over the long-term, local and regional responses by public health units will be deployed based on local context and conditions. Public health measures that may be applied locally could include reintroducing capacity limits and/or physical distancing, reducing gathering limits and adding settings where proof of vaccination is required, among others. Public health measures would be implemented provincially in exceptional circumstances, such as when the province’s health system capacity is at risk of becoming overwhelmed or if a vaccine resistant COVID-19 variant is identified in the province.

“We are now in a position where we can see the proposed plan for lifting the remaining public health and workplace safety measures in Ontario,” said Dr. Kieran Moore, Chief Medical Officer of Health. “The months ahead will require continued vigilance, as we don’t want to cause anymore unnecessary disruption to people’s everyday lives. We must continue to prevent the transmission of COVID-19 in our communities by following the public health measures in place and by vaccinating those who have not yet received their shots. Ontario has the infrastructure in place to manage outbreaks, including a high-volume capacity for testing, and people to perform fast and effective case and contact management when needed.”

With one of the most successful vaccination campaigns in the world, many businesses safely reopening, and employment now back to pre-pandemic levels, Canadians have reached a turning point in the fight against COVID-19. The government has now surpassed its target of creating a million new jobs. Canada is on the road to economic recovery—but some areas of the country and economy continue to need targeted support.

Today, the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance, announced that the government is taking targeted action to create jobs and spur economic growth. This includes moving from the very broad-based support that was appropriate at the height of lockdowns to more targeted measures that will provide help where it is needed, while prudently managing government spending.

The government is proposing the following changes to business support programs:

- Extend the Canada Recovery Hiring Program until May 7, 2022, for eligible employers with current revenue losses above 10 per cent and increase the subsidy rate to 50 per cent. The extension would help businesses continue to hire back workers and to create the additional jobs Canada needs for a full recovery.

- Deliver targeted support to businesses that are still facing significant pandemic-related challenges. Support would be available through two streams:

- Tourism and Hospitality Recovery Program, which would provide support through the wage and rent subsidy programs, to hotels, tour operators, travel agencies, and restaurants, with a subsidy rate of up to 75 per cent.

- Hardest-Hit Business Recovery Program, which would provide support through the wage and rent subsidy programs, would support other businesses that have faced deep losses, with a subsidy rate of up to 50 per cent.

- Applicants for these programs will use a new “two-key” eligibility system whereby they will need to demonstrate significant revenue losses over the course of 12 months of the pandemic, as well as revenue losses in the current month.

- Businesses that face temporary new local lockdowns will be eligible for up to the maximum amount of the wage and rent subsidy programs, during the local lockdown, regardless of losses over the course of the pandemic.

- These programs will be available until May 7, 2022, with the proposed subsidy rates available through to March 13, 2022. From March 13, 2022, to May 7, 2022, the subsidy rates will decrease by half.

To ensure that workers continue to have support and that no one is left behind, the government proposes to:

- Extend the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit until May 7, 2022, and increase the maximum duration of benefits by 2 weeks. This would extend the caregiving benefit from 42 to 44 weeks and the sickness benefit from 4 to 6 weeks.

- Establish the Canada Worker Lockdown Benefit which would provide $300 a week in income support to eligible workers should they be unable to work due to a local lockdown anytime between October 24, 2021 and May 7, 2022.

With these changes, the government is supporting the hardest-hit sectors and those who are affected by the virus while recognizing that broad-based assistance is no longer needed. These changes will continue to prioritize job creation and a strong economic recovery.

As the province continues to respond to the fourth wave of the pandemic driven by the highly transmissible Delta variant, the government is further protecting Ontarians through continued actions that encourage every eligible person to get vaccinated and help stop the spread of COVID-19.

Today the government released the regulations and guidance for businesses and organizations to support them in implementing proof of vaccination requirements, which take effect on September 22, 2021. Requiring proof of vaccination will help increase vaccination rates, protect individuals in higher-risk indoor settings, and keep businesses open.

“High rates of vaccination against COVID-19 are critical to helping protect our communities and hospital capacity while keeping Ontario schools and businesses safely open,” said Christine Elliott, Deputy Premier and Minister of Health. “As we continue our last mile push to increase vaccination rates, requiring proof of immunization in select settings will encourage even more Ontarians to receive the vaccine and stop the spread of COVID-19. If you haven’t received your first or second dose of the COVID-19 vaccine, please sign up today.”

In advance of September 22, all Ontarians can print or download their vaccination receipt from the provincial booking portal. The Ministry is working on additional supports and services to assist Ontario residents who need help obtaining proof of vaccination, including requesting a copy be sent by mail. Those who need support obtaining a copy of their vaccination receipt including those who do not have access to a computer or printer can call the Provincial Vaccine Contact Centre at 1-833-943-3900.

Ontario is developing an enhanced vaccine certificate with a unique QR code to make it safer, more secure and convenient to show that you have been vaccinated, when required to do so. The enhanced vaccine certificate and verification app will be available by October 22, 2021. Ontario’s proof of vaccination guidance will be updated to reflect the new processes.

“Businesses need a smart, quick and safe solution to verify vaccination,” said Kaleed Rasheed, Associate Minister of Digital Government. “The made-in-Ontario enhanced vaccine certificate for the public and the verification app for businesses are tools to confirm that an individual has been vaccinated while protecting Ontarians’ health data.”

The proof of vaccination policy has resulted in a marked increase in vaccination rates. Between September 1 and September 8, 2021, the seven-day average for first doses administered increased by more than 29 per cent, from over 11,400 doses to over 14,700 doses. During that time, more than 90,000 first doses and 102,000 second doses were administered in Ontario to individuals aged 18 to 59.

To further increase vaccine uptake, the province is continuing its last mile strategy to reach eligible individuals who have yet to receive a first or second dose. This includes:

- The provincial call centre booking or rebooking more than 135,000 appointments;

- The GO-VAXX bus administering more than 3,700 doses with 50 per cent being first doses, since launching on August 7, 2021;

- Setting up a Provincial Vaccine Confidence Line that individuals can call to speak with an experienced agent or health specialist about COVID-19 vaccine questions; and

- Supporting more than 550 vaccination clinics in or nearby elementary, secondary and post-secondary schools that are currently operational or planned for the near future.

“As we continue to see cases of COVID-19 in our communities, we must keep up the fight against the transmission of this virus and its variants to create a safer environment for ourselves, our families and our communities,” said Solicitor General Sylvia Jones. “The best defense against COVID-19 is getting a vaccine and encouraging everyone who is eligible to get vaccinated too. Wearing a mask and practising physical distancing where possible are public health measures we all must continue to follow.”

To further protect those who face the highest risk from COVID-19 and the Delta variant, the government, in consultation with the Chief Medical Officer of Health is following the evidence and recommendations from the National Advisory Committee on Immunization and will begin offering third doses of the COVID-19 vaccine to additional groups, such as individuals with moderate or severe primary immunodeficiency, individuals receiving active treatment for significantly immunosuppressive conditions and those with acquired immunodeficiency syndrome. Locations and timing for third doses will vary by public health unit and high-risk population based on local planning and considerations.

“Getting fully vaccinated is the most important step you can take to protect yourself and others,” said Dr. Kieran Moore, Chief Medical Officer of Health. “To provide the best protection to some of our more vulnerable populations, we are offering a third dose to additional groups of immunocompromised people who are more likely to have had a less than adequate immune response to the initial two dose COVID-19 vaccine series. I continue to strongly encourage anyone eligible who hasn’t already come forward to get their COVID-19 shot, to do so today to do their part to help keep themselves, their loved ones and our communities safe.”

To further protect Ontarians as the province continues to confront the Delta-driven fourth wave of the COVID-19, the government, in consultation with the Chief Medical Officer of Health, will require people to be fully vaccinated and provide proof of their vaccination status to access certain businesses and settings starting September 22, 2021. Requiring proof of vaccination in these settings reduces risk and is an important step to encourage every last eligible Ontarian to get their shot, which is critical to protecting the province’s hospital capacity, while also supporting businesses with the tools they need to keep customers safe, stay open and minimize disruptions.

“As the world continues its fight against the Delta variant, our government will never waver in our commitment to do what’s necessary to keep people safe, protect our hospitals and minimize disruptions to businesses,” said Premier Ford. “Based on the latest evidence and best advice, COVID-19 vaccine certificates give us the best chance to slow the spread of this virus while helping us to avoid further lockdowns. If you haven’t received your first or second dose of the COVID-19 vaccine, please do so today.”

As of September 22, 2021, Ontarians will need to be fully vaccinated (two doses plus 14 days) and provide their proof of vaccination along with photo ID to access certain public settings and facilities. This approach focuses on higher-risk indoor public settings where face coverings cannot always be worn and includes:

- Restaurants and bars (excluding outdoor patios, as well as delivery and takeout);

- Nightclubs (including outdoor areas of the establishment);

- Meeting and event spaces, such as banquet halls and conference/convention centres;

- Facilities used for sports and fitness activities and personal fitness training, such as gyms, fitness and recreational facilities with the exception of youth recreational sport;

- Sporting events;

- Casinos, bingo halls and gaming establishments;

- Concerts, music festivals, theatres and cinemas;

- Strip clubs, bathhouses and sex clubs;

- Racing venues (e.g., horse racing).

These mandatory requirements would not apply to outdoor settings where the risk of transmission is lower, including patios, with the exception of outdoor nightclub spaces given the risk associated with the setting. In addition, these requirements will not apply to settings where people receive medical care, food from grocery stores, medical supplies and the like. Aligned with public health measures currently in place, indoor masking policies will continue to remain in place.

“We know vaccines provide the best protection against COVID-19 and the Delta variant,” said Christine Elliott, Deputy Premier and Minister of Health. “To protect the health and well-being of Ontarians, our government will offer one more tool to encourage even more Ontarians to receive the vaccine and provide further protection to fully vaccinated Ontarians as they safely enjoy activities with their loved ones and support their local businesses.”

Individuals who cannot receive the vaccine due to medical exemptions will be permitted entry with a doctor’s note until recognized medical exemptions can be integrated as part of a digital vaccine certificate. Children who are 11 years of age and younger and unable to be vaccinated will also be exempted from these requirements.

For the period between September 22 and October 12, 2021, it is intended that people attending wedding or funeral receptions at meeting or event spaces will be able to provide a negative rapid antigen COVID-19 test from no more than 48 hours before the event as an alternative to proof of vaccination. These rapid antigen tests would have to be privately purchased.

Ontario will develop and provide additional tools to improve user experience, efficiency and business supports in the coming weeks, including establishing alternative tools for people with no email, health card or ID. The government will work to support implementation of vaccine certificates for Indigenous communities whether or not they have opted to enter their data into COVaxON, while maintaining Indigenous data governance, control, access and possession principles.

Ontarians currently have access to a paper or PDF vaccine receipt that includes all relevant information to prove that they are fully vaccinated. As of September 22, Ontarians will be required to show their vaccine receipt when entering designated settings along with another piece of photo identification, such as a driver’s licence or health card. This is similar initial implementation approach announced in British Columbia.

Ontario will also introduce an enhanced digital vaccine receipt that features a QR code, which is safe, more secure and with you wherever you go. This digital vaccine receipt can be kept on a phone and easily used to show that you've been vaccinated if you need to. In addition, the province will launch a new app to make it easier and more convenient for businesses and organizations to read and verify that a digital vaccine receipt is valid, while protecting your privacy.

As the 2021-22 school year begins, it is critical to keep Ontario schools safe and students learning in-person. The province will work with trusted public health units to use the existing COVaxON system to safely and securely confirm the vaccination status of students. The province is committed to keeping parents informed about how their child’s COVID-19 vaccine information and enrollment data is being used to keep schools safe. This will equip local public health units with the information they need to ensure rapid case and contact management if required to limit disruptions in the event of cases or outbreaks and keep kids in class.

“We are already seeing a rise in the number of cases of COVD-19 as we head into the fall,” said Dr. Kieran Moore, Chief Medical Officer of Health. “As we enter the last mile push to increase vaccination rates, the introduction of a vaccine certificate is an important step to give people the tools to limit further spread of the virus so that we can ensure the safety of all Ontarians while keeping the province open and operational.”

“Combining the use of a QR code with a trusted, made in Ontario verifier app will help support the province’s health measures,” said Kaleed Rasheed, Associate Minister of Digital Government. “These tools will provide a simpler, faster, and better way to prove vaccination status that is both convenient and secure – while also supporting businesses with an easy validation process.”

With key public health and health care indicators continuing to improve and the provincewide vaccination rate surpassing the targets outlined in the province’s Roadmap to Reopen, in consultation with the Chief Medical Officer of Health the Ontario government is moving the province into Step Three of the Roadmap to Reopen at 12:01 a.m. on Friday, July 16, 2021.

In order to enter Step Three of the Roadmap, Ontario needed to have vaccinated 70 to 80 per cent of individuals 18 years of age or older with one dose and 25 per cent with two doses for at least two weeks, ensuring a stronger level of protection against COVID-19. Thanks to the dedicated efforts of Ontario’s health care partners, as of July 8, 2021, over 77 per cent of the population in Ontario ages 12 and over have received one dose of a COVID-19 vaccine and over 50 per cent have received their second dose. More than 16.6 million doses of the COVID-19 vaccine have been administered provincewide.

“Ontario has continued to see improvements in key health indicators, allowing the province to move to Step Three of the Roadmap and safely resume more of the activities we’ve missed,” said Christine Elliott, Deputy Premier and Minister of Health. “While this is exciting news, we most still remain vigilant and continue to follow the public health measure we know work and keep us safe. Vaccines remain our ticket out of the pandemic so if you haven’t booked your appointment yet, please do so today.”

Step Three of the Roadmap focuses on the resumption of additional indoor services with larger numbers of people and restrictions in place. This includes, but is not limited to:

- Outdoor social gatherings and organized public events with up to 100 people with limited exceptions;

- Indoor social gatherings and organized public events with up to 25 people;

- Indoor religious services, rites or ceremonies, including wedding services and funeral services permitted with physical distancing;

- Indoor dining permitted with no limits on the number of patrons per table with physical distancing and other restrictions still in effect;

- Indoor sports and recreational fitness facilities to open subject to a maximum 50 per cent capacity of the indoor space. Capacity for indoor spectators is 50 per cent of the usual seating capacity or 1,000 people, whichever is less. Capacity for outdoor spectators is 75 per cent of the usual seating capacity or 15,000 people, whichever is less;

- Indoor meeting and event spaces permitted to operate with physical distancing and other restrictions still in effect and capacity limited to not exceed 50 per cent capacity or 1,000 people, (whichever is less);

- Essential and non-essential retail with with capacity limited to the number of people that can maintain a physical distance of two metres;

- Personal care services, including services requiring the removal of a face covering, with capacity limited to the number of people that can maintain a physical distance of two metres;

- Museums, galleries, historic sites, aquariums, zoos, landmarks, botanical gardens, science centres, casinos/bingo halls, amusement parks, fairs and rural exhibitions, festivals, with capacity limited to not exceed 50 per cent capacity indoors and 75 per cent capacity outdoors;

- Concert venues, cinemas, and theatres permitted to operate at:

- up to 50 per cent capacity indoors or a maximum limit of 1,000 people for seated events (whichever is less)

- up to 75 per cent capacity outdoors or a maximum limit of 5,000 people for unseated events (whichever is less); and up to 75 per cent capacity outdoors or a maximum of 15,000 people for events with fixed seating (whichever is less).

- Real estate open houses with capacity limited to the number of people that can maintain a physical distance of two metres; and

- Indoor food or drink establishments where dance facilities are provided, including nightclubs and restobars, permitted up to 25 per cent capacity or up to a maximum limit of 250 people (whichever is less).

Face coverings in indoor public settings and physical distancing requirements remain in place throughout Step Three. This is in alignment with the advice on personal public health measures issued by the Public Health Agency of Canada, while also accounting for Ontario specific information and requirements. Face coverings will also be required in some outdoor public settings as well.

Please view the regulation for the full list of public health and workplace safety measures that need to be followed.

“Thanks to the continued efforts of Ontarians adhering to public health measures and advice, as well as going out to get vaccinated, we have seen most key health indicators continue to improve,” said Dr. Kieran Moore, Chief Medical Officer of Health. “However, the pandemic is not over and we must all remain vigilant and continue following the measures and advice in place, as the Delta variant continues to pose a threat to public health.”

The province will remain in Step Three of the Roadmap for at least 21 days and until 80 per cent of the eligible population aged 12 and over has received one dose of a COVID-19 vaccine and 75 per cent have received their second, with no public health unit having less than 70 per cent of their eligible population aged 12 and over fully vaccinated. Other key public health and health care indicators must also continue to remain stable. Upon meeting these thresholds, the vast majority of public health and workplace safety measures, including capacity limits for indoor and outdoor settings and limits for social gatherings, will be lifted. Only a small number of measures will remain in place, including the requirement for passive screening, such as posting a sign, and businesses requiring a safety plan.

Ontario’s epidemiological situation is distinct from other jurisdictions and the Delta variant is the dominant strain in Ontario, which is not the case with some other provinces. As a result, on the advice of the Chief Medical Officer of Health, face coverings will also continue to be required for indoor public settings. The Chief Medical Officer of Health will continue to evaluate this need on an ongoing basis.

With key public health and health care indicators continuing to improve, the provincewide vaccination rate now surpassing the targets outlined in the province’s Roadmap to Reopen, and on the recommendation of the the Chief Medical Officer of Health, the Ontario government is moving the province into Step Two of its Roadmap to Reopen at 12:01 a.m. on Wednesday, June 30, 2021.

“Because of the tireless work of our health care heroes, and the record setting success of our vaccine rollout, we are able to move into Step Two ahead of schedule on June 30 with the support of our public health experts” said Premier Doug Ford. “We are proceeding safely with the re-opening of our province and will continue to work around the clock until the job is done.”

In order to enter Step Two of the Roadmap, Ontario needed to have vaccinated 70 per cent of adults with one dose and 20 per cent with two doses for at least two weeks, ensuring a strong level of protection against COVID-19. Thanks to the dedicated efforts of Ontario’s health care partners, as of June 23, 2021, over 76 per cent of the population in Ontario ages 18 and over have received one dose of a COVID-19 vaccine and over 29 per cent have received their second dose. More than 13.3 million doses of the COVID-19 vaccine have been administered provincewide.

Before entering Step Two, the province also needed to see continued improvement in key public health and health care indicators, including hospitalizations, ICU occupancy and the weekly cases incidence rates. After entering Step One, during the period of June 11 to 17, 2021, the provincial case rate decreased by 24.6 per cent. As of June 22, the number of patients with COVID-19 in ICUs is 305, including 10 patients from Manitoba, as compared to 450 two weeks ago. The province expects these positive trends to continue over the coming days before entering Step Two.

“Due to a continued improvement in key indicators, Ontario is ready to enter Step Two of our Roadmap, allowing us to safely and gradually ease public health measures while continuing to stop the spread of COVID-19,” said Christine Elliott, Deputy Premier and Minister of Health. “Thank you to the Ontarians who rolled up their sleeves to help us reach this exciting milestone. Every dose administered brings us one step closer to the things we’ve missed, so please sign up to receive the vaccine when it’s your turn.”

Step Two of the Roadmap focuses on the resumption of more outdoor activities and limited indoor services with small numbers of people where face coverings are worn, with other restrictions in place. This includes, but is not limited to:

- Outdoor social gatherings and organized public events with up to 25 people;

- Indoor social gatherings and organized public events with up to 5 people;

- Essential and other select retail permitted at 50 per cent capacity;

- Non-essential retail permitted at 25 per cent capacity;

- Personal care services where face coverings can be worn at all times, and at 25 per cent capacity and other restrictions;

- Outdoor dining with up to 6 people per table, with exceptions for larger households and other restrictions;

- Indoor religious services, rites, or ceremonies, including wedding services and funeral services permitted at up to 25 per cent capacity of the particular room;

- Outdoor fitness classes limited to the number of people who can maintain 3 metres of physical distance;

- Outdoor sports without contact or modified to avoid contact, with no specified limit on number of people or teams participating, with restrictions;

- Overnight camps for children operating in a manner consistent with the safety guidelines produced by the Office of the Chief Medical Officer of Health;

- Outdoor sport facilities with spectators permitted at 25 per cent capacity;

- Outdoor concert venues, theatres and cinemas, with spectators permitted at 25 per cent capacity;

- Outdoor horse racing and motor speedways, with spectators permitted at 25 per cent capacity;

- Outdoor fairs, rural exhibitions, festivals, permitted at 25 per cent capacity and with other restrictions.

Please view the regulation for the full list of public health and workplace safety measures that need to be followed.

While the province has surpassed Step Three vaccination targets, Ontario may remain in Step Two for a period of approximately 21 days to allow the most recent vaccinations to reach their full effectiveness and to evaluate any impacts of moving to Step Two on key public health and health care indicators. When it is determined to be safe, the province will promptly move to Step Three of the Roadmap to Reopen.

“Due to the continued commitment of Ontarians adhering to public health measures and going out to get vaccinated, we have seen our key health indicators continue to improve across the province,” said Dr. David Williams, Chief Medical Officer of Health. “While we can now begin preparing to ease public health measures under the Roadmap, the fight against COVID-19 is not over and we must continue adhering to the public health advice and measures currently in place to maintain this great progress.”

Based on the provincewide vaccination rate and continuing improvements in key public health and health system indicators, the Ontario government, in consultation with the Chief Medical Officer of Health, will move the province into Step One of its Roadmap to Reopen at 12:01 a.m. on Friday, June 11, 2021.

Step One of the Roadmap focuses on the resumption of more outdoor activities with smaller crowds where risk of transmission is lower. It will also permit more limited indoor settings to be open, all with restrictions in place. In consultation with the Chief Medical Officer of Health, the Ontario government has amended Step One to also permit indoor religious services, rites and ceremonies, including wedding and funeral services limited to 15 per cent capacity.

Step One of the Roadmap to Reopen includes but is not limited to:

- Outdoor social gatherings and organized public events with up to 10 people;

- Outdoor religious services, rites, or ceremonies, including wedding services and funeral services, capped at the number of people that can maintain a physical distance of two metres;

- Indoor religious services, rites, or ceremonies, including wedding services and funeral services permitted at up to 15 per cent capacity of the particular room;

- Non-essential retail permitted at 15 per cent capacity, with no restrictions on the goods that can be sold;

- Essential and other select retail permitted at 25 per cent capacity, with no restrictions on the goods that can be sold;

- Outdoor dining with up to four people per table, with exceptions for larger households;

- Outdoor fitness classes, outdoor groups in personal training and outdoor individual/team sport training to be permitted with up to 10 people, among other restrictions;

- Day camps for children permitted to operate in a manner consistent with the safety guidelines for COVID-19 produced by the Office of the Chief Medical Officer of Health;

- Overnight camping at campgrounds and campsites, including Ontario Parks, and short-term rentals;

- Concert venues, theatres and cinemas may open outdoors for the purpose of rehearsing or performing a recorded or broadcasted concert, artistic event, theatrical performance or other performance with no more than 10 performers, among other restrictions;

- Outdoor horse racing tracks and motor speedways permitted to operate without spectators; and

- Outdoor attractions such as zoos, landmarks, historic sites, botanical gardens with capacity and other restrictions.

The province will remain in Step One for at least 21 days to evaluate any impacts on key public health and health system indicators. If at the end of the 21 days the province has vaccinated 70 per cent of adults with one dose and 20 per cent of adults with two doses and there are continued improvements in other key public health and health system indicators, the province will move to Step Two of the Roadmap.

All public health and workplace safety measures currently in place will remain in effect until the province moves to Step One on June 11, 2021 at 12:01 a.m. During this time, the government will continue to work with stakeholders on their reopening plans, including targeted measures for specific sectors, institutions and other settings to ensure that they have full awareness of when they can begin to safely reopen and how.

The Ontario Government has extended the province-wide shutdown and strengthened the current Stay-at-Home order. Changes include:

- Prohibit all outdoor social gatherings and organized public events, except for with members of the same household or one other person from outside that household who lives alone or a caregiver for any member of the household;

- Close all non-essential workplaces in the construction sector;

- Reduce capacity limits to 25 per cent in all retail settings where in-store shopping is permitted. This includes supermarkets, grocery stores, convenience stores, indoor farmers' markets, other stores that primarily sell food and pharmacies; and,

- Close outdoor recreational amenities, such as golf courses, basketball courts and soccer fields with limited exceptions

The Ontario government, in consultation with the Chief Medical Officer of Health and other health experts, is immediately declaring a third provincial emergency under s 7.0.1 (1) of the Emergency Management and Civil Protection Act (EMPCA). These measures are being taken in response to the rapid increase in COVID-19 transmission, the threat on the province's hospital system capacity, and the increasing risks posed to the public by COVID-19 variants.

Effective Thursday, April 8, 2021 at 12:01 a.m., the government is issuing a province-wide Stay-at-Home order requiring everyone to remain at home except for essential purposes, such as going to the grocery store or pharmacy, accessing health care services (including getting vaccinated), for outdoor exercise , or for work that cannot be done remotely. As Ontario's health care capacity is threatened, the Stay-at-Home order, and other new and existing public health and workplace safety measures will work to preserve public health system capacity, safeguard vulnerable populations, allow for progress to be made with vaccinations and save lives.

Retail

In addition, the province is also strengthening public health and workplace safety measures for non-essential retail under the provincewide emergency brake. Measures include, but are not limited to:

- Limiting the majority of non-essential retailers to only operate for curbside pick-up and delivery, via appointment, between the hours of 7 a.m. and 8 p.m., with delivery of goods to patrons permitted between 6:00 am and 9:00 pm, and other restrictions;

- Restricting access to shopping malls to limited specified purposes, including access for curbside pick-up and delivery, via appointment, with one single designated location inside the shopping mall, and any number of designated locations outside the shopping mall, along with other restrictions;

- Restricting discount and big box stores in-person retail sales to grocery items, pet care supplies, household cleaning supplies, pharmaceutical items, health care items, and personal care items only;

- Permitting the following stores to operate for in-person retail by appointment only and subject to a 25 per cent capacity limit and restricting allowable hours of operation to between 7 a.m. and 8 p.m. with the delivery of goods to patrons permitted between 6 a.m. and 9 p.m.:

- Safety supply stores;

- Businesses that primarily sell, rent or repair assistive devices, aids or supplies, mobility devices, aids or supplies or medical devices, aids or supplies;

- Rental and leasing services including automobile, commercial and light industrial machinery and equipment rental;

- Optical stores that sell prescription eyewear to the public;

- Businesses that sell motor vehicles, boats and other watercraft;

- Vehicle and equipment repair and essential maintenance and vehicle and equipment rental services; and

- Retail stores operated by a telecommunications provider or service, which may only permit members of the public to enter the premises to purchase a cellphone or for repairs or technical support.

- Permitting outdoor garden centres and plant nurseries, and indoor greenhouses that engage in sales to the public, to operate with a 25 per cent capacity limit and a restriction on hours of operation to between 7 a.m. and 8 p.m.

These additional and strengthened public health and workplace safety measures will be in effect as of Thursday, April 8, 2021 at 12:01 a.m.

The Ontario government, in consultation with the Chief Medical Officer of Health and other health experts, is imposing a provincewide emergency brake as a result of an alarming surge in case numbers and COVID-19 hospitalizations across the province. The provincewide emergency brake will be effective Saturday, April 3, 2021, at 12:01 a.m. and the government intends to keep this in place for at least four weeks.

The provincewide emergency brake would put in place time-limited public health and workplace safety measures to help to stop the rapid transmission of COVID-19 variants in communities, protect hospital capacity and save lives. Measures include, but are not limited to:

- Prohibiting indoor organized public events and social gatherings and limiting the capacity for outdoor organized public events or social gatherings to a 5-person maximum, except for gatherings with members of the same household (the people you live with) or gatherings of members of one household and one other person from another household who lives alone.

- Restricting in-person shopping in all retail settings, including a 50 per cent capacity limit for supermarkets, grocery stores, convenience stores, indoor farmers' markets, other stores that primarily sell food and pharmacies, and 25 per cent for all other retail including big box stores, along with other public health and workplace safety measures;

- Prohibiting personal care services;

- Prohibiting indoor and outdoor dining. Restaurants, bars and other food or drink establishments will be permitted to operate by take-out, drive-through, and delivery only;

- Prohibiting the use of facilities for indoor or outdoor sports and recreational fitness (e.g., gyms) with very limited exceptions;

- Requiring day camps to close; and,

- Limiting capacity at weddings, funerals, and religious services, rites or ceremonies to 15 per cent occupancy per room indoors, and to the number of individuals that can maintain two metres of physical distance outdoors. This does not include social gatherings associated with these services such as receptions, which are not permitted indoors and are limited to five people outdoors.

On the advice of the Chief Medical Officer of Health, all Ontarians are asked to limit trips outside the home to necessities such as food, medication, medical appointments, supporting vulnerable community members, or exercising outdoors with members of their household. Employers in all industries should make every effort to allow employees to work from home.